What is the Amazon Lending Program?

Amazon describes its lending program as a facilitator for businesses. No business should have to be complicated. So the platform has designed financing solutions through the lending program. This program aims to help small and medium-sized businesses.

Simply put, these loans are short-term help offered to “qualified sellers.” This program was first launched back in 2011 when Amazon started seeing opportunities in the lending industry.

This Loan can start from 1000 dollars and rise to even 750000 dollars (which is pretty good for an online business on Amazon). Unlike banks that require serious taxing documents and will review your credit before loaning you a dime, Amazon only needs to ensure you have been a good seller on the platform and your customers have been relatively satisfied.

Why Should Sellers Use Amazon Lending?

Bank systems take too long to approve you for a loan and might not be appropriate for your immediate needs. Here is why you should try the Amazon Seller Lending Program instead of a bank loan:

- It’s quickly approved: based on the product you sell, the loan could take only a few days (1 to 5 business days).

- It’s hassle-free: no need to provide credit score, financial profile, or tax information. All you need to do is check your eligibility, request an invite, and wait for the result. Amazon will go through your seller account and determine if you qualify.

- It gives you the option to manage inventory: you can buy bulk products and fill your inventory ahead of time by getting a loan.

- It’s flexible: the Amazon Loan program provides sellers with more than one financing option (if you sell more than one product).

- It has a low-interest rate: the maximum interest for an Amazon loan is 16% (for a 12-month term). This is great for business owners who want to work long-term and grow their sales.

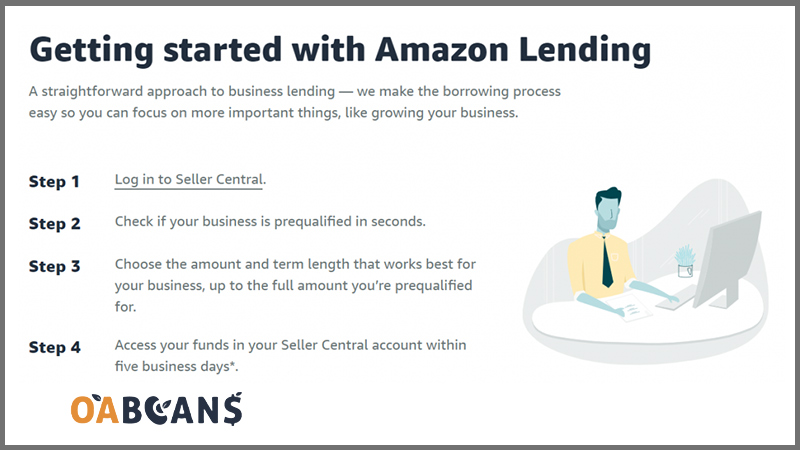

How to Get Funds from Amazon Lending?

Firstly, you should know that Amazon Lending is just for some sellers with specific features. To access these funds, you must maintain an active Amazon account in good standing, have a solid sales record and meet Amazon’s customer performance metrics. If you are invited, here are the steps you should follow:

Check for an invitation:

At first step, log in to your Seller Central dashboard and look for an Amazon Lending invitation banner or a notification.

Review the offer details

After receiving this banner, click on it to read the financing offer details, such as the product type, loan amount, interest rate and repayment terms. Amazon in 2025 offers three main types of financial products for sellers:

- Term Loan, which is a lump-sum loan with a fixed interest rate, repaid through equal monthly payments.

- Merchant Cash Advance (MCA) is an advance of funds that is automatically deducted as a set percentage of your future Amazon sales.

- Line of Credit, which is a flexible credit line with a specific limit, where you only pay interest on the amount you borrow and can draw funds up to your approved limit during a given period.

Prepare your documents

Before applying, make sure you have all the required documents ready. For example, recent bank statements, identification, and financial records are some essential documents. These are important and will help you complete your application smoothly.

Apply through Amazon Lending partners:

Now it’s time to click on Start Application and send your request to Amazon’s designated lending partner to access the funds. These partners may include Lendistry, Parafin, or Marcus by Goldman Sachs.

Approval and funding

Typically, after 1 to 3 business days, Amazon’s lending partner will review your application. If approved, you will receive a loan agreement to sign, and the funds will usually be disbursed to your bank account.

Repayment and monitoring

After receiving the funds, you must carefully manage your repayments. If your loan is a term loan, your monthly payment will be automatically deducted from your linked business checking account. Therefore, you should maintain sufficient funds in your account and ensure your Amazon disbursements remain consistent so that your payments are processed successfully.

When using Amazon Lending, you should make informed and strategic decisions to ensure the financing truly benefits your business. It’s important to know and follow some best practices.

- Compare the costs before accepting any loan. Carefully review the total borrowing cost, including interest rates or fees, and compare them with other financing options available in the market.

- Only take a loan with a clear business purpose. For example, investing in expanding your inventory or marketing efforts. This helps ensure you get a positive return from the funds you borrow.

- keep your seller metrics strong, because your eligibility for Amazon Lending depends on the health and performance of your Amazon account.

If the Amazon Lending offer doesn’t fit your needs, consider other financing options such as the Amazon Community Lending Program, independent fintech lenders, or traditional bank and SBA loans.

What Are the Requirements for Getting a Loan from Amazon?

Amazon Loan amount can be anywhere between 1000 and 750000 dollars. The good news is unlike many bank loans; there is no need to fix your credit or manage taxes before applying. But you should meet these requirements:

- A selling history of (at least) 12 months

- Having sold at least 10000$ in the past year

- Good customer satisfaction metrics (low return rates, positive reviews, etc.)

- No serious customer complaints in the past six months

- No serious copyright or trademark complaints and issues

- Following the Amazon listing guides

These are some of the things you should do to get a loan approved by the Amazon platform. The best way to ensure you are eligible for Amazon Loan Program is to follow the rules and try your best to avoid trouble right from the start. If you have a low return rate and customers have left positive reviews for your product, Amazon will know that you are a growing business and also serious in your practices, so it loans you more quickly and easily.

Eligible countries for this lending program are:

- Canada

- China

- France

- Germany

- Italy

- Spain

- India

- The United Kingdom

- The US (except Panama Canal Zone, Virgin Islands, Vermont, Utah, Tennessee, South Dakota, Puerto Rico, and North Dakota)

Types of Business Loans That Amazon Lending Offers

You should know that the Amazon Lending program has expanded over the years and now, in 2025, provides a variety of financing options for sellers. If you want to get a loan, you should have complete information and understand each type, then choose the one that best matches your business goals.

Merchant Cash Advance (MCA)

This financing option allows Amazon to provide sellers with a lump sum of money upfront. Instead of fixed monthly payments, repayment is made automatically as a percentage of each sale . The main benefit of this option is flexibility because payments adjust based on your sales, and there is no personal collateral or credit check required.

But, MCAs often come with high fees, leading to a higher effective APR. So, this type is ideal for sellers who need quick access to funds and have consistent monthly sales.

Amazon Community Lending Program

In this program, Amazon partners with Lendistry to support small and medium sized businesses by offering long-term loans. This program is very useful for businesses looking for affordable financing but unable to obtain loans from traditional banks.

Amazon Business Line of Credit

This option gives sellers flexible access to funds from Amazon’s financial partners, like Goldman Sachs and SellersFi. Sellers can draw money up to their approved limit. It’s an excellent choice for managing working capital or taking advantage of sensitive times in sales.

Business Term Loans

Amazon’s Business Term Loans provide sellers with a fixed amount of money that is repaid over a specific period through equal payments. These loans are ideal for long-term business growth, for example expanding inventory or funding marketing campaigns.

Amazon Interest-Only Loans

This program allows sellers to pay only the interest for an initial period before repaying the full principal later. It is a good option for businesses expecting growth in the near future. However, they must be careful, because they will need to make larger payments once the principal repayment period begins. This type of loan is suitable for sellers who need temporary financial flexibility but have a clear plan to cover the full repayment later.

How to Sign Up for Amazon Lending Program?

When your business’s financial survival depends on a certain amount of money, Amazon loans can be the first thing that comes to your mind. Although the process is pretty straightforward, it is essential to do it right and complete all the steps.

Here is how:

- First, log in to seller central and enter your account.

- In seller central, click on “growth” then “lending.”

- On the opened page, click on the “Amazon Lending” option. This option is only visible if you are an eligible seller for the program.

- Select the amount and the term you would like on the opened page.

- Follow the rest of the steps (as stated in the form) and submit your approval.

- Approving a loan request usually takes up to five business days. After this, the funds should be deposited into your account.

You should be satisfied if you are not eligible for the Amazon Lending Program yet. You may become eligible later as you sell more and start working on your rank and return rates (and customer care). The platform will send you an invitation as soon as you meet all the conditions.

Why Don’t Banks Loan Money to the Amazon Sellers?

Let’s remember: banking is an ancient practice (that still works), and the nature of some of its rules and regulations just can’t be aligned with modern businesses like Amazon FBA. Many banks in the US and Europe are still conservative, and the idea of FBA, online arbitrage, drop shipping, etc., is just outside their area of expertise. To lend you money, banks need to make sure you can pay it back no matter what. Although it seems unfair, a bank won’t give you (or your business) money unless you already have money.

Many banks need help finding the right reason to ensure a small business owner on Amazon will make enough profits to pay them back. So they won’t give them loans. Also, many Amazon sellers can’t get along with repayment terms, agreements, and relatively high-interest rates bank-paid loans.

Final Thoughts

Amazon loans can be an excellent option for businesses that need urgent money to take care of their operations and fill their inventories. You can rely on this program even if you are a small business, and 1000 dollars can help you. Amazon cares a lot about its customers and will loan the businesses it is sure will finally benefit the buyers. So it’s best to keep an eye on your product rank, return rates, and seller status on the platform. Study the needs of your business and gather knowledge about the payback and conditions of the loan.

FAQs

Amazon will deduct your payments from the first seller disbursements following the loan due date. If this disbursement is insufficient, the remaining amount will be deducted from the remaining balance.

There is a slight rise in loan interest if you fail to pay Amazon when due. The platform may charge you interest at the rate of 1.5% of the amount of the outstanding payment for the month.

In some FBA cases, an Amazon seller should personally guarantee the payment of the loan. Then if it is not paid, the borrower can be required to repay the loan personally.

There are some requirements for approved sellers. If you have these, you are automatically an eligible seller and can apply for a loan anytime.

11 responses to “Amazon Seller Lending Program Guide”

Your website is a must-read for anyone in the Amazon online arbitrage niche. You offer a level of expertise and guidance that is unparalleled, and I have seen significant growth in my business thanks to your advice.

By using Amazon FBA, you can offer a wider range of products to your customers without worrying about the logistics of fulfilling orders.

With Amazon FBA, you can automate many aspects of your ecommerce business, allowing you to scale your operations without sacrificing quality.

Your website provides a comprehensive guide to starting an Amazon FBA business, covering all aspects from product research to marketing. I appreciate the tips and strategies shared that are based on real-life experiences.

I highly recommend your website to anyone who wants to succeed in Amazon reselling. You’re doing an amazing job!

Your tips on pricing products competitively for Amazon reselling are really insightful. I’ve implemented some of your ideas in my own business.

Sellers using Amazon FBA benefit from Amazon’s robust seller feedback system, which helps build trust and reputation among customers.

Amazon’s fulfillment options, such as Multi-Channel Fulfillment, enable you to expand your reselling business beyond Amazon’s platform and reach customers on other channels.

I love the thrill of finding hidden gems and profitable deals through Amazon online arbitrage. It’s like a treasure hunt every day!

The FBA program offers a reliable payment system, ensuring timely and secure transactions for your business.

With reselling on Amazon, you have the freedom to choose the products you want to sell, giving you the flexibility to specialize in specific niches or cater to a broad audience.